The Supply Chain Calamity

Discussing the consequences of the trade slowdown and uncertainty caused by Trump's reckless tariffs.

We all know the unsettling feeling of the calm before a storm. Those first chilled gales cutting through the air, dispersing the radiant warmth of a sunny day, as mountainous umbral clouds infiltrate the horizon. Perhaps your bones creak as the pressure changes, or old scars begin to throb with the memory of pain you once endured. The rattling of the trees betray the shifting of the wind, and the birds draw quiet and still. Then, in those final minutes before the downpour, you begin to pick up the familiar scent of ozone and petrichor in the air, an imminent warning before the sky unleashes its deluge upon the Earth.

Metaphorically, we are experiencing a similar calm in regard to the consequences of America’s aggressive move toward protectionism with the implementation of reckless blanket tariffs (I realize that was a hard pivot from creative imagery to economic politics, but I hope it got the point across). Within weeks, we are approaching a supply chain calamity that will rival the pandemic, and not nearly enough people know about it! And no, I am not exaggerating.

Trump’s Global Trade War:

As I’m sure we all know by now, the Trump administration has unleashed a flurry of tariffs in his first 100 days on countries across the globe (even the penguins aren’t safe!). He has offered many different explanations about what the aim of these tariffs are — many of which are contradictory to the logical outcome — but the main claim is his desire to bring back manufacturing to the United States (I will keep the explanation for why tariffs are counterproductive brief, as this has been discussed repeatedly over the last few months). Bringing back American industry sounds good on paper, but tariffs are not the way to accomplish that goal. We have plenty of historical data proving this to be the case, and what makes this rhetoric even grander in its ignorance is the fact that Trump tried tariffs in his first term, and they were damaging overall to American manufacturing and agriculture industries. The Federal Reserve Bank of Richmond has a more detailed brief analyzing the estimated impacts of the current tariff policies1, from which I have pulled the following describing the 2018 tariffs:

Although these tariffs provided some targeted economic benefits by increasing employment in protected sectors, they ultimately produced a net loss to the U.S. economy. A 2019 working paper found that tariffs generated approximately $51 billion (about 0.27 percent of GDP) in losses for consumers and firms reliant on imported goods, though factoring in job gains within protected industries reduced the net loss to about $7.2 billion, or roughly 0.04 percent of GDP.

Additionally, although tariffs boosted employment in specific protected sectors, they resulted in a relative employment decline of about 1.8 percent — equivalent to approximately 220,000 jobs lost in industries heavily dependent on imported inputs — as firms faced higher production costs. When accounting for China's retaliatory tariffs on U.S. exports and subsequent economic impacts, a 2024 working paper estimates that the total employment reduction rises to approximately 2.6 percent, equivalent to about 320,000 jobs.

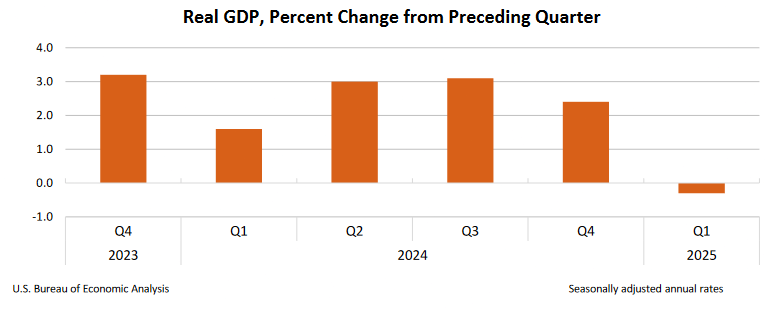

As expected by every economist, Trump’s global trade war caused a crash in the stock market, and has drawn the ire of nearly all of our international allies. Furthermore, according to a recent BEA report2, GDP growth was negative in Q1 of this year. This is due primarily to an increase in importing from companies looking to stock up before the tariffs were implemented, as well as an overall reduction in consumer spending.

Tariffs in effect as of May 8th:

Most countries have a flat tariff of 10%, and increases have been paused for 90 days for countries that are open to negotiation (more like coercion really). However, there are a few exceptions:

145% tariffs have been levied on China in an escalating response to their reciprocal tariffs on the US.

Mexico and Canada have been targeted by 25% tariffs specifically because of alleged fentanyl crossing the border. However, goods specified in the 2020 USMCA trade deal are exempted.

Countries that are already being tariffed at higher rates were excluded from the blanket 10%

Section 232 tariffs on steel and aluminum remain unchanged at 25%

A 25% tariff has been placed on all imported car and auto parts

Exemptions have been made for imported smartphones, computers, and microchips

The First Dominoes // Cancelled Orders & Empty Vessels:

With economic policy (all policy really) you have to remember that there is a delay in effect. There is rarely ever one inciting incident that causes a big crash, it’s usually trends over a longer period of time. The same goes for the supply chain; orders are made months in advance, and big companies have stock stored that they can pull from because they planned in advance for the tariffs to come into effect. But the glass house is starting to crack, little by little, and it will shatter all at once.

Due to the highest tariffs being put on China, the west coast will be hit the hardest by the supply chain disruptions that are coming. The Port of Los Angeles reported that there is an estimated 35% decline in cargo arriving in port3, and upwards of a 60% decrease in ocean-freight bookings4 from China to the U.S; furthermore, 25% of bookings have been cancelled. In response, many container-ship operators are switching to smaller ships5, or cancelling trips they think won’t be worth it because of the lack of cargo. In about a month or two, I reckon, we are going to start seeing some serious shortages due to these tariffs.

The industries that will be the most immediately affected are shipping companies and truckers, small businesses, and farmers. Truckers are going to have difficulty getting assignments in the coming months because of lack of cargo. Small businesses that rely on imported goods will be forced to eat the cost and raise prices, as many other countries like India and Vietnam are not interested in taking their smaller orders. Farmers have already seen negatives; In March, China bought more soybeans from Brazil in one month than ever in their history. Last time this happened, during the 2018-19 trade dispute with China, the USDA estimates farmers lost $27 billion in exports6, offset by about $28 billion in federal aid (and good luck getting Trump to bail you out now).

Now, I want to make it clear that I strive for accuracy, even when the narrative would help my point. I’ve seen a lot of social media posts talking about empty ports, but this isn’t an inaccurate depiction of what’s going on right now. Don’t get me wrong, a 35% decrease in cargo is catastrophic, but it doesn’t mean empty ports, and it’s not going to be the end of the world for consumers; Things will just be harder to get sometimes, and unfortunately, more expensive. If you want to know more details, the YouTube channel What’s Going On With Shipping? is good at breaking things down from someone who knows how to read all those shipping maps and what all the terminology means. Here’s a good video addressing this:

The Damage is Already Done // The Bullwhip Effect:

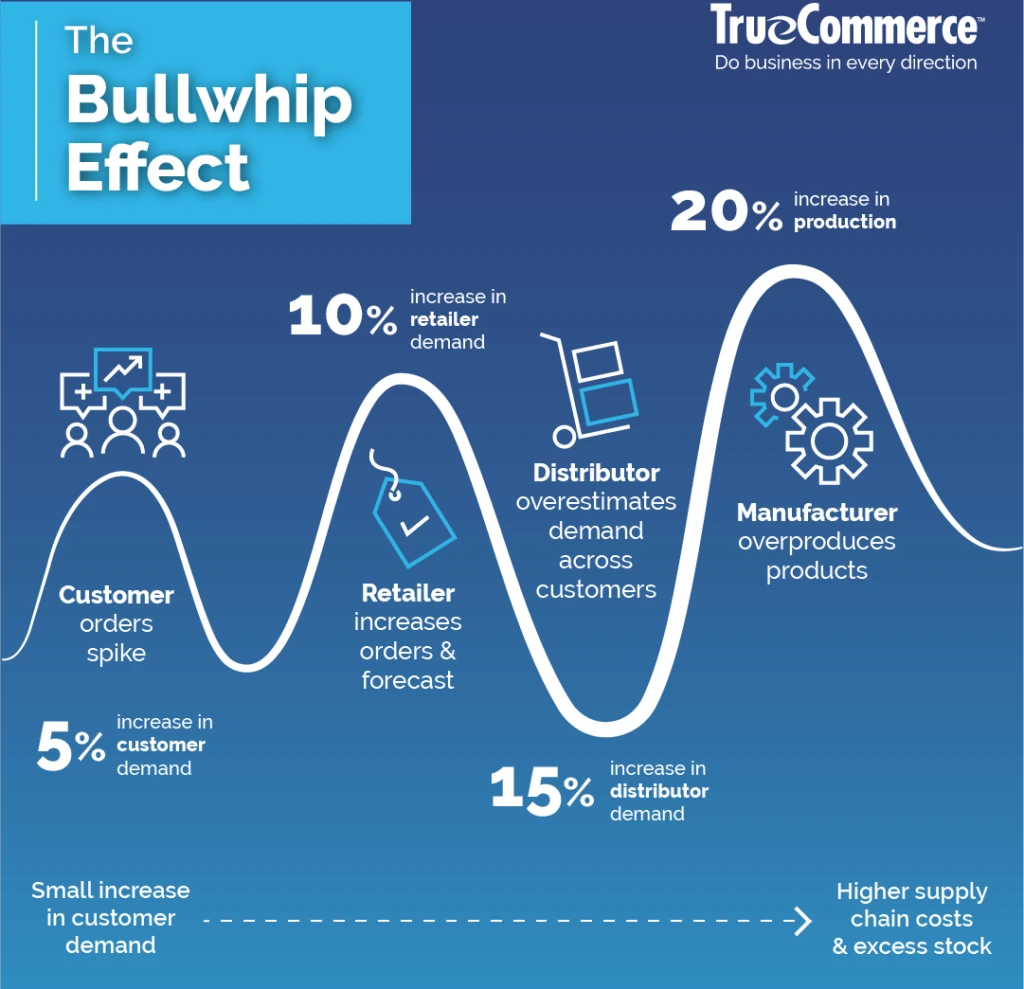

If you’re holding on to hope that Trump and China can resolve this trade dispute, and the subsequent repeal or lowering of the tariffs will save us, I’m sorry to tell you, but the damage is already done. The instability caused by this sudden shift in global economy will cause ripple affects for longer than you likely think it will. Because of the substantial delay between manufacturing and selling, different levels of the supply chain can become out of sync, or respond to false signals, creating a bullwhip effect.

The bullwhip effect is an economic phenomenon that occurs when unpredictable demand causes a distortion that amplifies as it travels up the supply chain, much like a whip becomes faster and more powerful as the applied force travels to the tip. A sudden demand increase at the retail end causes retailers to increase their order; Distributors see this increase in demand and increase their order in anticipation of future orders following this trend; Likewise, manufacturers increase their order to the supplier, resulting in a compounded increase all the way up the supply chain. This miscommunication often causes scarcity and surge pricing initially, then oversupply and stock surplus when demand returns to normal, which costs more for the manufacturers and suppliers, and creates uncertainty in the labor-force.

I’m sure we all remember seeing similar supply chain disruptions throughout the pandemic, and after the blockage of the Suez Canal by the Evergreen container ship. Famously, when the pandemic first started there was a huge run on toilet paper which caused stocking issues for a short period of time (Sidenote: Why the hell do people go for toilet paper first during an emergency? How much toilet paper are you using that you need a closet full of it? I get wanting to have some in stock, but even if you run out, you can just use the shower and a rag. Also, the vast majority of toilet paper in the US is manufactured domestically, so it is one of the things least affected by supply chain issues!).

How to Prepare:

After all that, I’m sure you’re wondering what you should buy before it is too late. Even Trump’s staff has admitted to stocking up lately! My advice would be, first, to consider cutting back on the budget in general. As I hope I’ve made clear, the economic fallout and supply chain chaos that will come from these tariffs will not end soon; It’s likely we’re headed toward a recession, just to be real. It’s better to get used to budgeting and saving a bit of money here and there before that happens. A few pieces of advice for that:

Check thrift stores before you buy something new, especially clothes

Cut back on the amount of meat you eat, it’s getting very expensive. Also, avoid fish until the tariffs are removed, because a lot of fish is imported from East Asia. (Cutting back on meat and fish also comes with the added benefit of being better for the environment*)

Buy in bulk when you can

Stop drinking so many disposable drinks! Seriously, drinks take up so much of the budget when grocery shopping, and they’re mostly bad for you. You will notice the difference. And stop with the bottled water! Just put a filter on your sink or get a filtered jug.

Try to only buy things on Debit. If you need to use credit, I get it, but having that runway tends to make you feel like you have money you don’t really have. And if you use a credit card, try to pay it off as soon as possible.

Second, I would advise you look ahead for anything you will need to replace in the very near future, anything you have been putting off fixing (especially car related), and for any birthdays and/or holidays. The last one particularly if you have kids, because toys and clothes are about to skyrocket if the 145% tariffs remain in place, so get them their gifts now, and do back to school shopping as soon as possible!

Here is a tariff simulator showing which industries will be hit hardest based on the country it is exporting from: https://www.interos.ai/tariffs-explorers/

And here is a Reddit thread on r/TwoXPreppers with a list of items that will likely be impacted: https://www.reddit.com/r/TwoXPreppers/comments/1kd7cmp/list_of_items_that_will_likely_be_impacted_by/

Lastly, I ask that you remember how these tariffs are affecting all of us, and pass that knowledge on to others. Tell your kids, and your grand-kids! It’s unacceptable that we already learned the tariff lesson 7 years ago in 2018, yet we somehow instantly forgot that tariffs are dogshit economic policy! And never, under any circumstances, allow a Republican to say that Democrats worse for the economy.

Ever vigilant, your eyes in the sky,

~Minerva

Thank you for such a wonderful analysis. We all need to be ready for the crisis.

Great article.